New Factor Concentrates, The Future is Now!

By Paul Clement

Reprinted with permission @2013 LA Kelley Communications in the Parent Empowerment Newsletter, August 2013

By year’s end, as many as three new hemophilia products could be on the market. Next year? Expect at least another three products, and more to follow. The most new products ever released for hemophilia treatment so close together—now filling the “pipeline”—will present choices. Should you switch products? What features might make these new products better than what you currently use? Any risks associated with switching? Should you switch right away, or wait and see?

You’ll make better choices about products when you know what to look for, what your needs are, and what questions to ask your physician. But first, it helps to know more about the bleeding disorder marketplace, and your role as a customer.

The US Bleeding Disorder Market

Who are the new products targeting? Let’s look at the customers in the US bleeding disorder market—the people who use clotting factor concentrates (“factor”). Most factor is used by people with hemophilia, and because hemophilia is a rare disorder, this obviously limits the size of the market and the number of customers.

Currently about 20,000 people have hemophilia in the US; about 80% of them have hemophilia A, and 3,000 to 4,000 have hemophilia B. About 400 US babies with hemophilia are born each year.

But the actual US market for factor concentrates is even smaller than these 20,000 people. That’s because only people with severe hemophilia tend to use factor regularly. This means only 8,000 to 14,000 people—a very small pool of customers.

Besides hemophilia A and B, the bleeding disorder market includes two additional groups: people with hemophilia who have inhibitors, and those with von Willebrand disease (VWD), which is sometimes treated with clotting factor.

Of the 20,000 Americans with hemophilia, about 1,200 have inhibitors—antibodies created by the body’s immune system that neutralize or inactivate infused factor. In people who produce high levels of inhibitors, the factor is made useless within minutes. People with low levels of inhibitors may be able to control bleeds with large doses of standard factor concentrates. But people with high levels of inhibitors need special factor concentrates called bypassing agents to control bleeding. Because the number of people with inhibitors is so small, they represent a niche market.

Von Willebrand disease is the most common bleeding disorder, affecting about 1% of the population. Of the estimated 3 million Americans with VWD, few are diagnosed. Why? Because unfortunately, VWD isn’t easy to diagnose. And for most people with VWD, the symptoms are mild, so they never seek medical help or even realize they have a bleeding disorder.

There are three VWD subtypes: type 1, type 2, and type 3. Type 1 is the mildest and most common form, accounting for about 75% of cases and only rarely requiring factor for treatment. Type 2 accounts for about 20% of VWD cases, with symptoms that are also generally mild and that usually don’t require a factor infusion. Type 3 is the rarest and most severe, characterized by joint and muscle bleeds. Bleeds in people with VWD type 3 are usually treated with a special type of factor VIII concentrate that also contains von Willebrand factor (VWF). Of Americans with VWD, only about 8,000 have type 3 and need regular treatment with factor.

Product Types

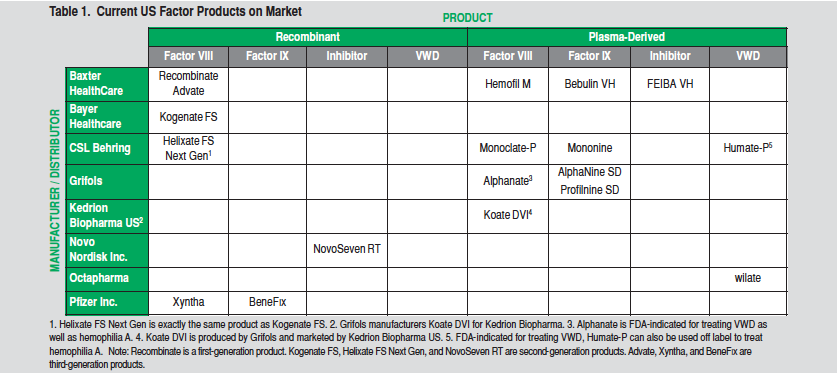

Products are bought and sold on a market. In the bleeding disorder market, “products” means factor. To understand what new factor products are coming to market, you first need to know what’s currently available. Factor concentrates are classified in several ways. The most obvious is by factor type:

• Hemophilia A patients use factor VIII (FVIII)

• Hemophilia B patients use factor IX (FIX)

• Inhibitor patients use bypassing agents (factor VIIa [FVIIa] or FEIBA)

• VWD patients use factor VIII with VWF (VWF/FVIII complex)

All factor concentrates are also classified by the source of the factor:

• Plasma or

• Cell cultures (recombinant factor)

Plasma-derived factor (sometimes abbreviated pd) is extracted from human blood plasma collected and pooled from tens of thousands of donors.

Recombinant factor does not come from blood. It’s produced by using recombinant DNA technology, in which the gene for a human clotting factor is spliced into another cell (usually a hamster cell). Large numbers of these genetically engineered cells are then grown in giant vats (bioreactors) containing a nutrient-enriched broth (growth medium). The cells secrete the factor into the growth medium, which is then harvested, and the factor is extracted. An r placed before the factor type indicates that it’s recombinant: rFVIII, rFIX.

Recombinant FVIII is also classified as either full length or B-domain deleted (BDD). Full-length factor VIII consists of the entire factor VIII molecule. BDD factor VIII has the center section of the molecule (the B domain) removed; the B domain is not necessary for activity of the factor molecule. BDD factor is shorter than full-length factor and is easier for the genetically engineered cells being grown in the bioreactors to produce.

Finally, recombinant factors are classified into three generations, based on whether they contain extra human or animal proteins. First-generation recombinant factors contain added human and/or animal proteins in both the growth medium and the final product.1 Second-generation recombinant factor concentrates contain no added human or animal proteins in the final product, but do use these proteins in the growth medium. Third-generation recombinant factor concentrates contain no added human or animal proteins in either the growth medium or the final product.

The Manufacturers and the Current Market

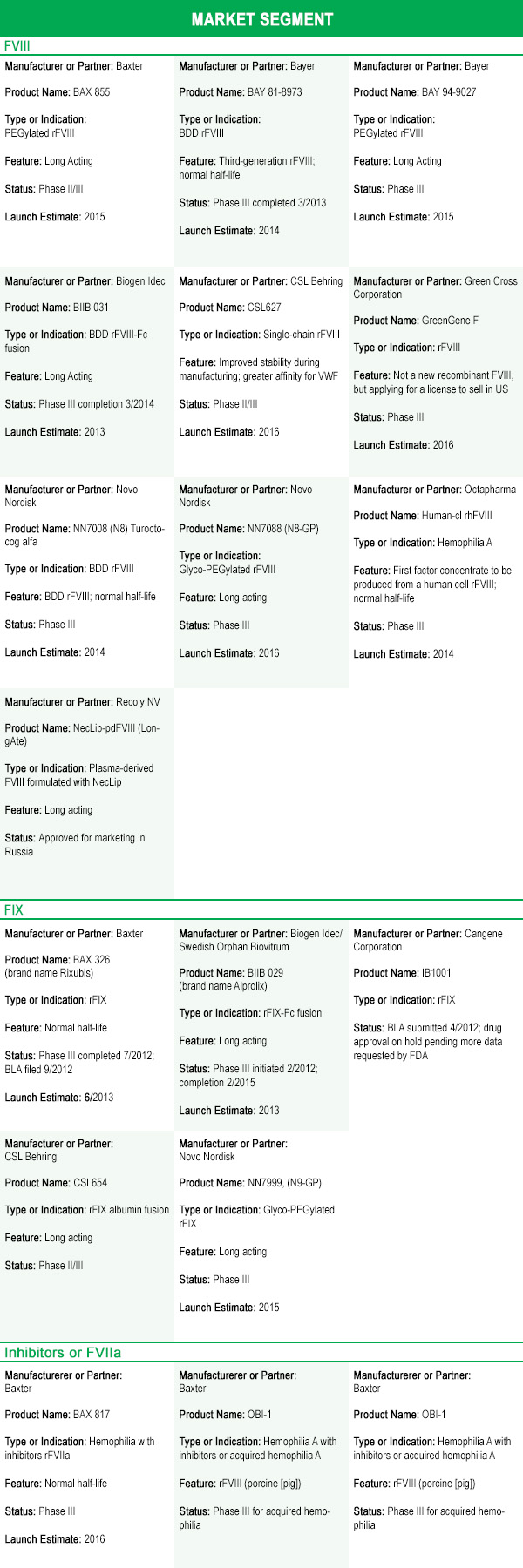

The global bleeding disorder market generated $8.5 billion in sales in 2011. That’s expected to grow to $11.4 billion by 2016, mainly due to increased use of prophylaxis in developed countries, as well as pharmaceutical companies’ expansion of markets into underserved countries. The bleeding disorder market in the US is dominated by eight pharmaceutical companies.

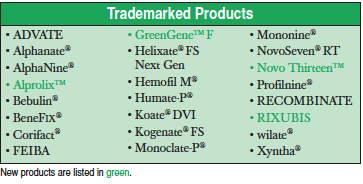

Because the sale of clotting factor is profitable, the US bleeding disorder market supports a relatively large number of products, despite the small customer base. Table 1 lists factor concentrates currently available in the US. Although the majority of the products listed are plasma-derived, recombinant products account for the most sales. Recombinant products comprise almost 90% of US sales, with most patients under age 20 on recombinant products.

A Burst in New Product Development

Although many new products for bleeding disorders are coming to market in the next few years, most are being developed by current manufacturers. It’s unlikely that we’ll see more than two new manufacturers enter the market. Why? On average, it costs $1.2 billion to develop a new biologic drug (a drug made from living cells) such as a clotting factor—that’s too expensive for most small companies.

Developing a new product is also risky: only 1 in 1,000 drugs in research and development ever makes it to market. It’s even tough for big pharmaceutical companies with decades of experience in developing and manufacturing factor: Bayer, Baxter, Novo Nordisk, and Pfizer, all major players in the hemophilia market, each recently suspended work on one or more of their new products under development because of lack of efficacy (effectiveness) or because of increased immunogenicity (more-than-expected cases of inhibitors or allergic reactions).

Along with cost and risk, patents and FDA regulations can also be major hurdles.2 Pharmaceutical companies can patent their new drugs and manufacturing processes, preventing other companies from copying their products for up to 20 years. Also, the FDA encourages the development of treatments for rare diseases by allowing a drug company to apply for orphan drug status. This status covers most clotting factors, allowing for tax breaks, fee waivers and reductions, and periods of data and marketing exclusivity—when the FDA will not approve a generic version of the drug for treating the same disease or condition. For biologic drugs, the period of exclusivity is seven years. These protections allow a company to recoup its investment in developing the drug, without fear of competition. The reasoning is that without such protections, most companies would be unwilling to take on the financial risk of developing a drug to treat a rare disorder if the company is unlikely to recoup its investment.3

So, with all these roadblocks and risks, why are almost 30 new treatments for bleeding disorders ready to enter the market in the next few years?

You’ve probably guessed: the patents and orphan drug periods of exclusivity on factor concentrates have expired or will soon expire. This has allowed for the development of generic forms of factor concentrates, called biosimilars or follow-on biologics. Biosimilars with improved properties, such as long-acting factor, are often referred to as “biobetters.” With the loss of patents and manufacturer protections, and the introduction of biosimilars and biobetters, pharmaceutical companies will face increasing competition—potentially cutting into their market share and profits. To maintain competitiveness, most companies are developing additional products as well as “new and improved” products.

The New Products

As they lose the protection of patents and orphan drug periods of exclusivity, pharmaceutical companies are looking not only to retain their market share, but also to grab market share from their competitors by introducing new products—you’ve probably been hearing about some of these.

But getting people with hemophilia to switch products is notoriously difficult when patients view benefits as small or incremental. In fact, some have argued that the current rFVIII products are all essentially the same in terms of safety and efficacy, leading to a lack of motivation to switch between products. Pharmaceutical companies know this, and they don’t expect to take the bleeding disorder market by storm. Instead, they hope to start by taking little bites out of their competitors’ market share by introducing biobetters, and by building their own market share with new products slowly over time. The bleeding disorder market is expected to be able to support some new products, and it’s expected to grow almost 6% yearly—about $500 million—over the next five to ten years.

So how can pharmaceutical companies maintain their market share or gain a toehold in a new niche market with increased competition? Most are using two approaches:

- targeting segments of the market that have historically had little or no competition (FVII, FIX, FXIII) with new products; and (2) introducing “new and improved” biobetter versions of current products. For some products, “improved” means either being the only third-generation recombinant or being produced by a human cell line. But for most products, “improved” means longer acting.

What Long-Acting Factor Really Means

Much of the research into developing new products also involves making them longer acting—extending their half-life. Let’s take a look at what half-life means. When factor is infused, some of it is used up in producing blood clots, but most of it is removed, or “cleared,” from the bloodstream; the body does this through multiple processes that continually clear and recycle proteins from the blood. Different clotting factors, as well as other proteins, have a different life span in the blood; some are short, measured in hours, while others are longer and may last weeks. The term half-life is often used to describe how quickly a protein or drug is cleared from the blood: the half-life is the amount of time it takes for one-half of a drug to be cleared from the blood. The half-life varies with each clotting factor, and also varies from person to person. For FVIII, the half-life is 8–12 hours. For FIX, it’s 18–24 hours. For FVII, the half-life is much shorter at a little over 2 hours. For patients with inhibitors, the half-life of factor may be very short—sometimes measured in minutes instead of hours.

Factor with a longer half-life would offer obvious benefits: fewer infusions, presumably fewer bleeds, lower lifetime cost, and better quality of life. Imagine having to infuse only once a week for prophylaxis instead of every other day!

Besides working on making factor longer acting, most pharmaceutical companies in the hemophilia business are also developing new products for market segments that have historically had little or no competition. These include FVII, FIX, and FXIII, explained in the following sections.

Recombinant factor VII, activated (rFVIIa); FEIBA

Since 1999, Novo Nordisk has cornered the factor VIIa market with its second-generation rFVIIa

product, NovoSeven, which is used to treat inhibitors in hemophilia A or B, congenital FVII deficiency, and acquired hemophilia. NovoSeven has a very short half-life (2.3 hours) and often requires two or more doses in quick succession to control a bleed in people with inhibitors. This drug has been successful for Novo Nordisk, and it’s no surprise that several of Novo Nordisk’s competitors are bringing their own rFVIIa products to market.

Several new rFVIIa products may hit the market within the next few years. Baxter expects a new rFVIIa to be on the market within three years. CSL Behring has a long-acting version of rFVIIa under development. Pfizer/Catalyst Biosciences is working on a new rFVIIa. Finally, rEVO Biologics is developing a new rFVIIa produced by transgenic rabbits that contain the gene for human FVII and produce the factor in their milk.

Factor IX

BeneFix, a third-generation rFIX product now sold by Pfizer, has held the market on rFIX since 1997. Now, five new rFIX products are poised to hit the market within the next few years (two in 2013). Three of the new longer-acting rFIX products—from Biogen Idec (a newcomer to the US hemophilia market), Novo Nordisk, and CSL Behring—have reported half-lives extended to 3.5–4 days, compared to 1 day for BeneFix. These extended half-life products will represent a significant breakthrough in treating bleeds in hemophilia B, and would allow prophylaxis with infusions once a week to once every two weeks. Other, normal half-life products coming to market may make the hemophilia B market more competitive, and may be cheaper than BeneFix.

Factor XIII

Only one FXIII product, Corifact (plasma-derived and produced by CSL Behring), is on the market. With the introduction of its product Novo Thirteen in 2014, Novo Nordisk will have the first and only recombinant FXIII on the market. This is truly a niche market: factor XIII deficiency is a very rare disorder, with only about 1,000 patients identified worldwide, 150 living in the US.

Will the New Factors Be Safe?

Yes, if they are approved. FDA approval for biologic drugs such as factor requires a complete series of clinical trials to check for safety, efficacy, and immunogenicity. This is because biosimilars and biobetters can never be made identical to the original drug. It’s fortunate that the FDA requires these trials: more than six biobetters for treating bleeding disorders have had their development terminated during clinical trials because of lack of efficacy or increased immunogenicity.

Even though the FDA may certify a drug as safe to market, the bleeding disorder community has raised two concerns about switching to new or longer-acting products: (1) the use of PEGylation to enhance half-life, and (2) the risk of developing inhibitors.

PEGylation involves attaching long chains of polyethylene glycol (PEG) to the factor. PEG is used in many products, including prescription and over-the-counter drugs, and in many cosmetics and other products such as toothpaste. Most of us have some PEG in our bodies from products we use every day. PEGylation has been used successfully and safely in several drugs for short-term treatment since 1990. Although a few instances have been reported of children experiencing negative side effects from taking PEG-based laxatives, for example, PEG is considered a safe compound.

If PEG is safe, what are the concerns?

Most PEGylated drugs use small chains of PEG that can be removed from the blood by the kidneys and excreted through the urine. But PEGylation of factor uses very long chains of PEG, which cannot be eliminated like small chains of PEG because they are too large to be excreted by the kidney. This leaves the liver to do the work of removing PEG. The liver removes some PEG by concentrating it in the bile it generates and then dumps into the intestines, to be excreted with the feces. But removal of PEG by the liver is less effective than removal by the kidneys, and some PEG remains behind. So what happens to the remaining PEG? We all have an immune system that ingests foreign materials (such as PEG); if those materials can’t be broken down, they remain in the cells of the immune system for a very long time.

We really don’t know what happens to PEG: does it accumulate over many years? And what, if any, long-term consequences result? Some researchers have speculated that because hemophilia requires lifelong treatment, PEG might build up to toxic levels in the liver over time. But researchers developing PEGylated factor scoff at this idea, citing the long safety record of PEGylated drugs and the fact that the amount of PEG infused with factor is miniscule. Also, to date no toxic effects of PEG on humans have been reported in clinical trials of PEGylated factor.

So who is right? Because it’s hard to track the passage of long chains of PEG through the human body, we don’t know exactly how PEG is excreted or whether it builds up in the body over time. It may be decades before the safety of long-term use is validated. With no evidence to the contrary, the FDA considers PEG, as used in PEGylated drugs, to be safe.

For most consumers, the key concern about switching products is probably the risk if developing inhibitors. For decades, we’ve heard anecdotal accounts of people who switched products and developed inhibitors—the dreaded complication of hemophilia. This fear of inhibitors is a prime reason that many are reluctant to switch products.

But this fear has finally been put to rest, as least in most cases!

A study published in January 2013 tracked inhibitor development in 574 children with severe hemophilia between 2000 and 2010.5 It found that 32.4% of the children developed inhibitors, with 22.4% of these being high-titer inhibitors (the more serious form). The study also found that the inhibitor risk was similar for plasma-derived and recombinant factor; that the VWF content had no effect on incidence of inhibitors; and, perhaps most important, that switching between products had no effect on the incidence of inhibitors. The one exception was that second-generation recombinant products carried a significantly higher risk of inhibitor development than third-generation full-length recombinant products. So far, there is no explanation for this difference.

Numerous other studies have come out in the past year that confirm that switching does not increase the risk of inhibitors: most older patients in the US have switched products several times, and in some countries, much of the hemophilic population has switched multiple times when the country purchases a different product every several years. The bottom line: switching products is not a risk.

Should I Switch?

That’s the looming question that you and your hematologist must answer. But some people may have more incentive than others to switch.

If you have hemophilia B, you’ll soon have the option of switching to one of several products that are significantly longer acting than the current rFIX product, BeneFix. A significantly longer-acting rFIX product would allow for prophylaxis once every one to two weeks—for many, that’s a powerful incentive to switch. Also, one or two new third-generation rFIX products with a normal half-life will also come to market. It’s hoped that the added competition from these newer third-generation products will lower the cost of these products.

The same goes for people with factor VII deficiency, acquired hemophilia, or hemophilia A or B with inhibitors. Many currently use the rFVIIa product NovoSeven, which has a short half-life and often requires multiple successive infusions to control a bleed. A long-acting rFVIIa product that allows a bleed to be controlled with fewer infusions—that’s also a powerful incentive to switch. Although the development of three long-acting rFVIIa products was terminated during clinical trials due to development of inhibitors to the products, one long-acting product is still in clinical trials, and two normal half-life products are under development. It’s hoped that, because of increased competition, these products will come to market at a significantly lower price than the current NovoSeven, helping to reduce the cost of this very expensive therapy.

And of course, people with factor XIII deficiency will now have a second product to use: a third-generation rFXIII product from Novo Nordisk called Novo Thirteen. Another powerful incentive to switch.

What about the rest of the 80% of people with hemophilia, who have hemophilia A without inhibitors? A handful of longer-acting rFVIII products are in clinical trials, as well as two normal half-life products. The long-acting rFVIII products in the pipeline have shown a modest 20%–60% increase in half-life; and although this is nowhere near the increase in half-life seen for biobetter rFIX products, it’s still nothing to ignore. Biogen Idec, the only company so far to have released phase III clinical trial data, has demonstrated that prophylaxis with its long-acting product can be achieved with only one to two infusions per week, as opposed to the commonly used regimen of three infusions per week.6 This translates into 50 to 100 or fewer infusions per year!

Given that switching products is not a risk for inhibitors, the big question is this: what is enough incentive to motivate people to switch products? Consumers usually compare benefits to cost. The benefit of long-acting factor, for example, would be fewer infusions for prophylaxis. Will consumers be willing to pay more per unit for this? A price close to that of current products, or the prospect of cost savings realized through fewer infusions, might entice healthcare professionals and consumers to switch to save money. Cost is the big unknown: will new normal half-life products come to market at a cheaper price in order to gain a market share? Will the longer-acting products cost significantly more? Or will pharmaceutical companies price them competitively to maintain or gain market share? We’ll see.

The Pipeline Starts Delivering

The bleeding disorder community has anticipated the arrival of new products for several years—and it’s finally time! As new products come to market, starting in 2013 and continuing for the next several years, we can expect more product choices and improved products. For some, the decision to switch will be easy—the new products will offer significant advantages over current products and may greatly improve quality of life.

For others, the improvements may be incremental and the decision to switch will be tougher. But whether you switch or not, the increased competition among factor manufacturers can only benefit our community. Get ready. New products are coming: the prospects are bright and the future is now!

1. In most first-generation recombinant factor concentrates, such as Recombinate, human albumin from blood plasma is typically added to the final container to increase bulk and stabilize the factor.

2. It can also be argued that treatments for many rare diseases and disorders would not exist without patents and favorable FDA regulations.

3. In June 2013, the US Supreme Court ruled that naturally occurring genes cannot be patented. This ruling immediately invalidated several thousand gene patents, but it does not apply to genetically engineered genes that have been modified by humans.

5. “Factor VIII Products and Inhibitor Development in Severe Hemophilia A,” Samantha Gouw, Johanna van der Bom, Rolf Ljung, et al. New England Journal of Medicine 368 (Jan. 17, 2013), 231–39. The study was funded by Bayer HealthCare and Baxter BioScience.

6. Biogen Idec press release, May 13, 2013, www.biogenidec.com.